How to Manage Tax Rate Changes in Busy Software

We all know that government is changing tax rates in GST day by day. Under GST regime there have been frequent changes related to reporting and tax rates and will continue for some more time. One such latest change is change in tax rate of many products. A lot of Items have been moved from 28% to 18% or 12%. Some other Items have been moved from 18% to 12% and so on.In this document, we will discuss that how you can manage tax rate change of an Item in Busy Software with effect from a certain date, without affecting the old voucher entries -

You can also click here to check the list of items and their new GST Rates, whose taxes have reduced in Nov 2017 GST Council Meeting

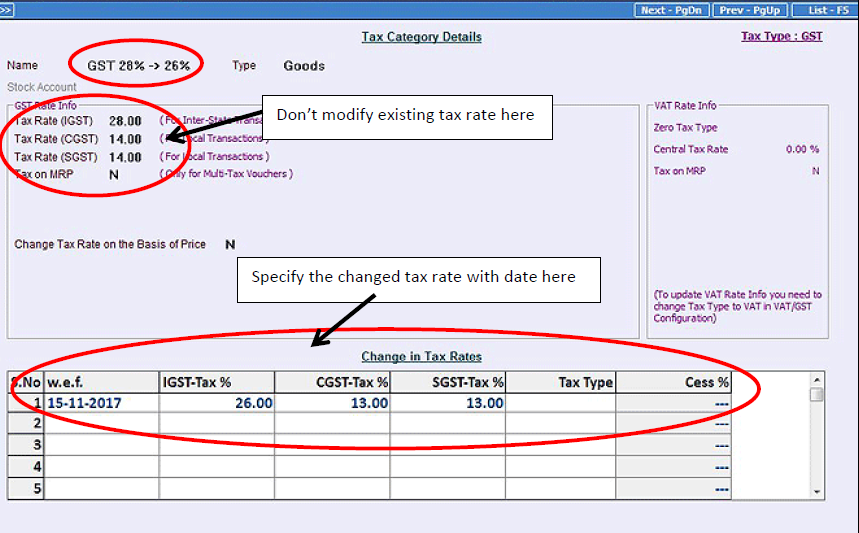

Case 1: Tax rate for all the Items under a specific rate changed to another rate like 28% changed to 26%

If tax rate for all the Items under a specific rate is changed to another rate then you can simply modify the existing tax category for that tax rate and specify new rate with effect from specified date. For example if 28% slab changed to 26%, simply modify existing tax category for 28% and specify new rate as 26% as shown below. No need to modify any Item.

Case 2: Tax rate for some of the Items changed to another rate like some of the Items in 28% moved to 18% or 12%

Let us assume that you had 10 Items under 28% and out of them 3 have been moved to 18% and 2 moved to 12%.

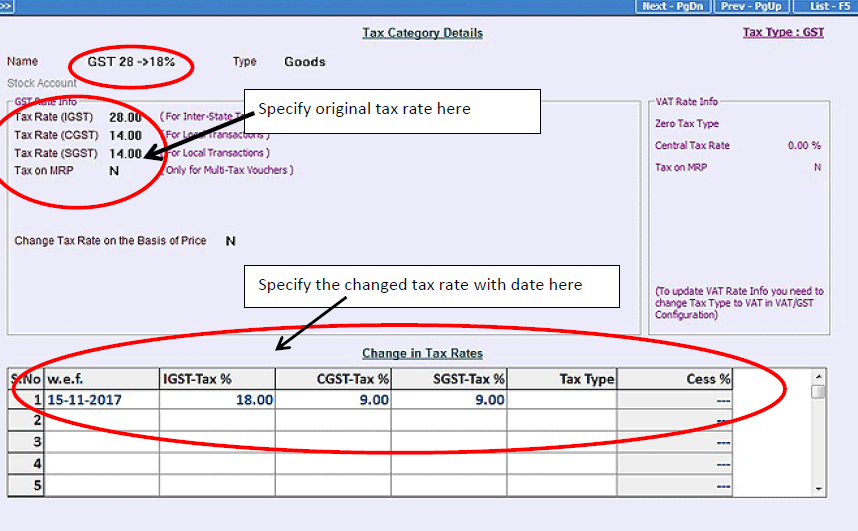

In this case we cannot modify existing tax category of 28% because it will impact all Items tagged with it. So, we need to create new tax category masters with the name like GST 28 -> 18% & GST 28 -> 12% and specify new rate with effect from specified date. Given below is the screenshot of Tax Category Master for Tax Category GST 28 -> 18%.

Similarly, you should create new Tax Category master for changes in other tax rates like GST 28 -> 12%, GST 18 -> 12 %, GST 12 -> 5 % and so on.

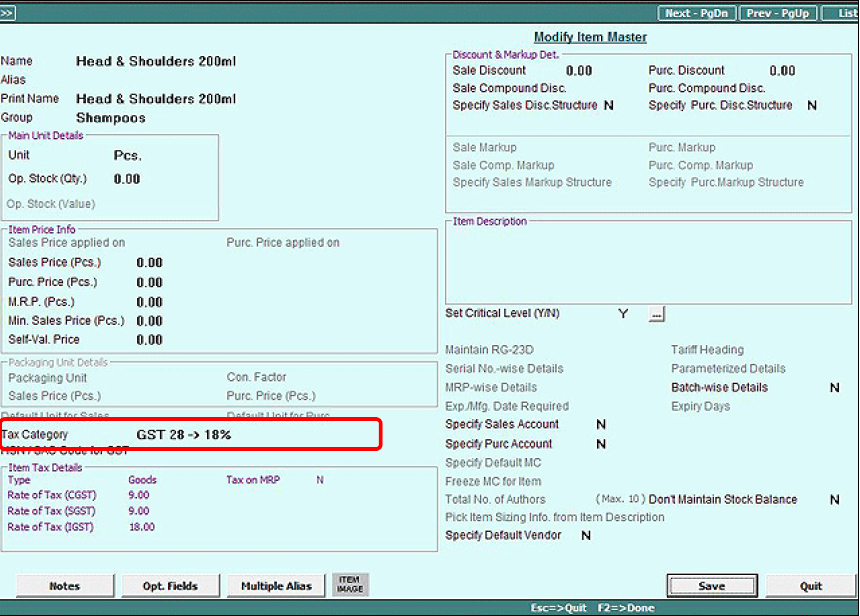

After creating new Tax Category masters, next step will be to tag Tax Category master to the required Item masters. For example, Shampoos were earlier taxable at 28% and now they are taxable at 18%, so in Shampoo Item master, you will tag GST 28 -> 18% Tax Category master. Given below is the screenshot of Item master with new Tax Category tagged.

Please note that you are only required to change the Tax Category for items whose tax rates have been changed. For items whose tax rates have not been changed there is no need to make any changes.

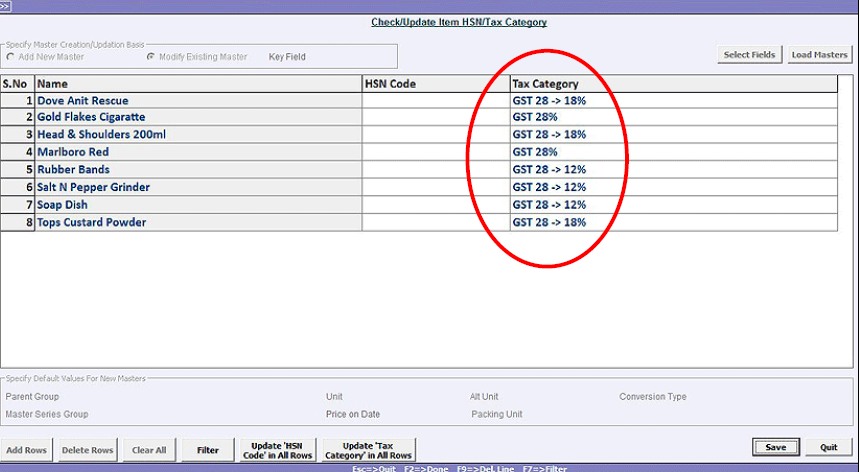

You can also change Item’s Tax Category in bulk using Administration->Masters->Bulk Updation->Check/Update Item HSN/Tax Category. Given below is the screenshot for the same.

With the help of above option you can check/update Tax Category of multiple Items in one go.

You can also click here to check the list of items and their new GST Rates, whose taxes have reduced in Nov 2017 GST Council Meeting

Like us on Facebook :

Related Posts

Top 21 Reasons to Upgrade to Busy 21

You can find here in this post Top 21 reasons to upgrade to BUSY 21. And how it will help you in your daily business needs

View More...

How to send FREE WHATSAPP directly from BUSY Accounting Software

Here we will tell you how to send Whatsapp messages directly from Busy Accounting Software officially. This is not a patch or Add-on, rather this feature is provided free of cost in Busy 21 version for the benefit of Busy Users

View More...

Tips to learn before you create New Financial Year in BUSY

3 most important tips, that you should remember before you start working on New Financial Year in Busy Accounting Software. We have also tried to describe the following things...

View More...

Shortcut Keys in Busy Accounting Software

Learn how to save your time and maximize your output in less time in your existing software. In this video we are going to teach you how you can increase your working speed on Busy Accounting Software by learning various shortcut keys and maximize use of your keyboard instead of mouse. We will also teach you various shortcut keys that will help you in working in Multi-tasking mode...

View More...

Benefits and Usage of Busy BNS Mobile App

Learn all the hidden benefits and usage of BusyBNS Mobile App and Send notifications to you and your customers

View More...